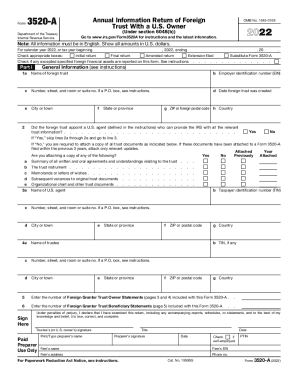

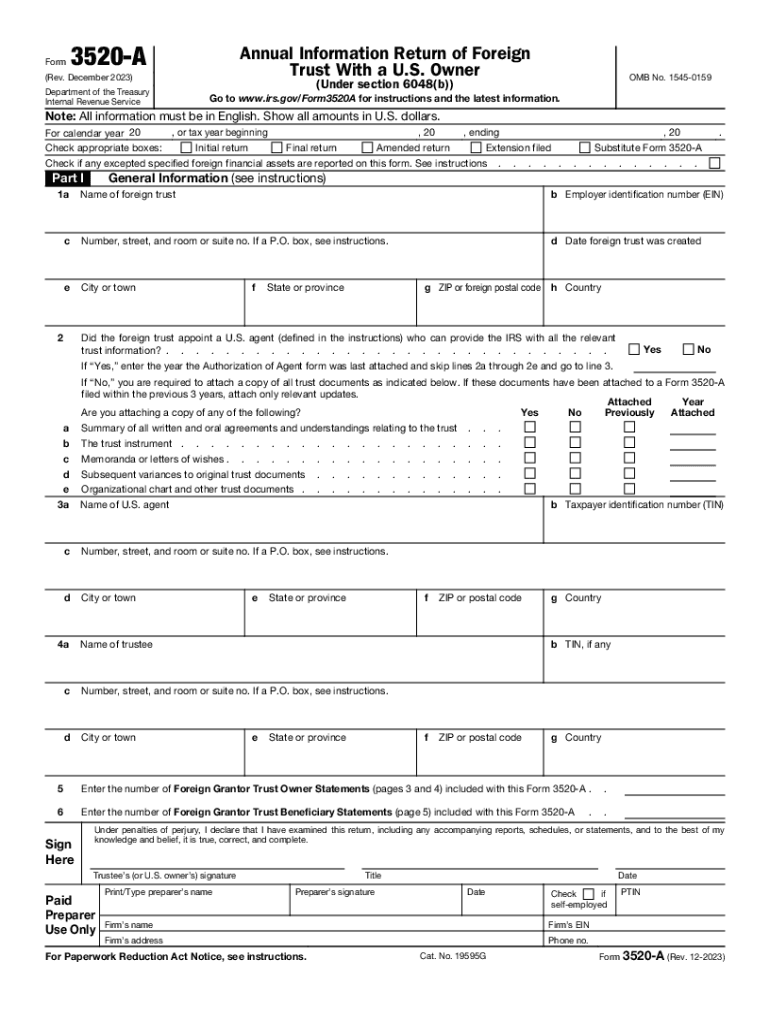

IRS 3520-A 2023-2026 free printable template

Instructions and Help about IRS 3520-A

How to edit IRS 3520-A

How to fill out IRS 3520-A

Latest updates to IRS 3520-A

All You Need to Know About IRS 3520-A

What is IRS 3520-A?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3520-A

What should I do if I realize I've made a mistake on my IRS 3520-A after submission?

If you discover an error on your IRS 3520-A after filing, you can submit an amended return. To do this, prepare a new IRS 3520-A with the correct information. It's essential to clearly indicate that the submission is an amendment for correct processing.

How can I verify if my IRS 3520-A has been received by the IRS?

To verify receipt of your IRS 3520-A, you can contact the IRS directly after allowing a reasonable processing period. Additionally, retaining proof of mailing or e-filing can help you confirm your submission status.

Are there any specific privacy measures I should take when filing IRS 3520-A?

When filing your IRS 3520-A, ensure that your personal information is protected. Use secure channels for submission and consider using e-signatures if applicable. Retain records securely per IRS guidelines to protect against data breaches.

What should I do if I receive an audit notice related to my IRS 3520-A?

If you receive an audit notice regarding your IRS 3520-A, review the notice carefully to understand the concerns raised. Prepare any requested documentation and consider seeking assistance from a tax professional to ensure a proper response.

Can I use third-party software to file my IRS 3520-A, and what should I be aware of?

Yes, many third-party software solutions are compatible for filing IRS 3520-A. When using these tools, ensure they meet the latest IRS technical requirements, and double-check the accuracy of your entries to avoid common filing errors.