IRS 3520-A 2023-2025 free printable template

Show details

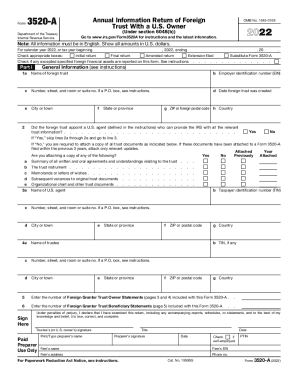

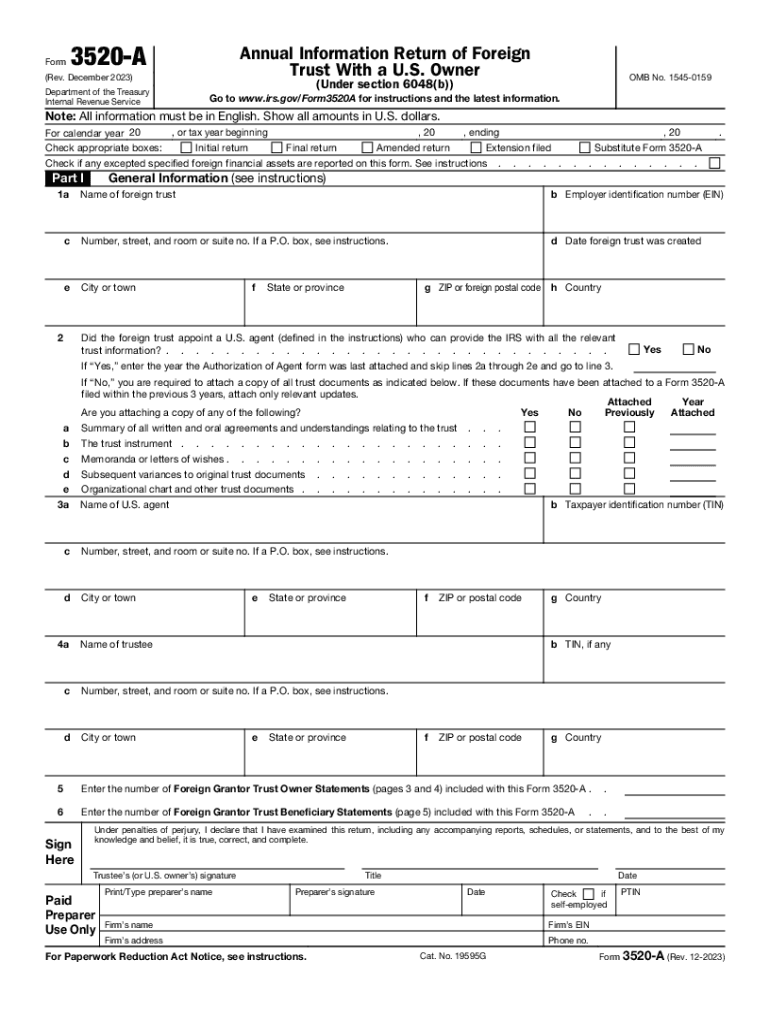

Form3520AAnnual Information Return of Foreign

Trust With a U.S. Owner(Rev. December 2023)

Department of the Treasury

Internal Revenue ServiceOMB No. 15450159(Under section 6048(b))Go to www.irs.gov/Form3520A

pdfFiller is not affiliated with IRS

Understanding and Utilizing the IRS 3520-A Form

Comprehensive Steps for Editing IRS 3520-A

Instructions for Completing the IRS 3520-A

Understanding and Utilizing the IRS 3520-A Form

The IRS 3520-A form is a crucial document for U.S. taxpayers who possess interests in foreign trusts or receive certain foreign gifts. Understanding this form is essential to comply with tax laws, avoid penalties, and maintain good standing with the IRS. This guide will provide in-depth information about the IRS 3520-A form, including how to fill it out accurately, recent changes, key insights, exemptions, and associated penalties.

Comprehensive Steps for Editing IRS 3520-A

Editing the IRS 3520-A requires careful attention to detail to ensure accurate information is presented. Follow these steps:

01

Review the current version of the form for completeness.

02

Check all entries for accuracy, including names, addresses, and identifying numbers.

03

Update any changes in trust ownership or related transactions since the last submission.

04

Make any necessary calculations for foreign trust assets or receipts.

05

Proofread your form for any possible errors or omissions before final submission.

Instructions for Completing the IRS 3520-A

Completing the IRS 3520-A involves several critical steps to ensure compliance. Here’s how to effectively fill the form:

01

Gather necessary documentation, such as trust agreements and accounting records.

02

Input the trust name, address, and taxpayer identification number in the designated fields.

03

Provide details about the trust’s grantor and beneficiaries.

04

Report the trust’s financial activity, including any distributions to U.S. persons.

05

Review all entries to affirm accuracy, and consider consulting a tax professional if needed.

Show more

Show less

Recent Updates and Modifications to IRS 3520-A

Recent Updates and Modifications to IRS 3520-A

In recent years, the IRS has implemented important changes to the IRS 3520-A form. Notably:

01

Increased asset reporting requirements for foreign trusts, impacting high-net-worth individuals.

02

Adjustments to submission deadlines that align more closely with individual tax return due dates.

03

Clarifications regarding the definition of trust income and distributions.

Essential Insights Regarding IRS 3520-A

What is the IRS 3520-A Form?

What is the Purpose of the IRS 3520-A?

Who is Required to Complete This Form?

When do Exemptions Apply to IRS 3520-A?

Components of IRS 3520-A

Filing Deadline for IRS 3520-A

Comparing IRS 3520-A with Similar Forms

Transactions Covered by the IRS 3520-A

Number of Copies Required for Submission

Penalties for Failure to Submit IRS 3520-A

Information Required for Filing IRS 3520-A

Other Forms Accompanying IRS 3520-A

Submission Address for IRS 3520-A

Essential Insights Regarding IRS 3520-A

What is the IRS 3520-A Form?

The IRS 3520-A form is a United States tax form used to report information about foreign trusts with U.S. owners, as well as the receipt of certain foreign gifts. The form serves to inform the IRS about foreign financial interests, promoting transparency and compliance with tax obligations.

What is the Purpose of the IRS 3520-A?

The primary purpose of the IRS 3520-A form is to ensure that U.S. taxpayers disclose foreign trust relationships and comply with their tax reporting obligations. It helps the IRS monitor foreign income and gifts, helping to curb tax evasion.

Who is Required to Complete This Form?

U.S. persons who have ownership interests in foreign trusts or who receive large gifts from foreign sources must complete the IRS 3520-A. This includes but is not limited to:

01

Grantors of foreign trusts.

02

Beneficiaries receiving distributions from such trusts.

03

Individuals receiving gifts exceeding $100,000 from foreign persons.

When do Exemptions Apply to IRS 3520-A?

Certain exemptions apply to the IRS 3520-A form. Conditions for potential exemptions include:

01

Income from foreign trusts that does not exceed specific thresholds.

02

Trusts qualifying under specific IRS regulations as non-reportable.

03

Entities such as estates that do not engage in foreign transactions.

Components of IRS 3520-A

The form consists of multiple sections, including:

01

Part I: Identification of the trust and each U.S. owner.

02

Part II: Information regarding the assets and income of the trust.

03

Part III: Details about distributions made to U.S. beneficiaries.

Filing Deadline for IRS 3520-A

The filing deadline for IRS 3520-A is generally the 15th day of the third month following the end of the trust's tax year. For trusts with a tax year ending December 31, the due date would be March 15 of the following year. If you cannot meet this deadline, filing for an extension may be necessary.

Comparing IRS 3520-A with Similar Forms

When evaluating IRS 3520-A against similar forms like IRS Form 3520, it's important to note:

01

IRS Form 3520 is used specifically for reporting transactions with foreign trusts and gifts, while Form 3520-A focuses on the trust's operational details.

02

Penalties for non-compliance vary, with Form 3520 carrying its own set of consequences distinct from Form 3520-A.

Transactions Covered by the IRS 3520-A

This form covers various transactions related to foreign trusts, such as:

01

Distributions made to U.S. beneficiaries.

02

Contributions or transfers made to the trust.

03

Transactional reports that may signify the trust's compliance with IRS regulations.

Number of Copies Required for Submission

Typically, only one copy of IRS 3520-A is required for submission to the IRS. However, keeping a copy for your personal records is highly advisable for future reference.

Penalties for Failure to Submit IRS 3520-A

The consequences of failing to submit IRS 3520-A can be severe and include:

01

Initial penalties of $10,000 for failure to file, with additional fees for continued non-compliance.

02

Failure to report distributed income may result in a 35% penalty on the amount unpaid.

03

Potential criminal charges for willful neglect, including hefty fines or incarceration.

Information Required for Filing IRS 3520-A

Essential information needed includes:

01

Identification details of the trust, including taxpayer IDs.

02

The financial performance of the trust during the reporting period.

03

Details about distributions to U.S. persons or entities.

Other Forms Accompanying IRS 3520-A

At times, additional forms may need to accompany the IRS 3520-A, including:

01

IRS Form 3520 for reporting foreign gifts.

02

IRS Form 8938 if the trust has specified foreign financial assets exceeding reporting thresholds.

Submission Address for IRS 3520-A

The IRS 3520-A form should be mailed to the following address:

01

Internal Revenue Service

02

P.O. Box 409101

03

Ogden, UT 84409

By understanding the intricacies of IRS 3520-A, taxpayers can ensure compliance, avoid substantial penalties, and take proactive measures to manage their foreign trust obligations. If you have further questions or need assistance, consider consulting a tax professional or utilizing resources like pdfFiller to streamline your filing process.

Show more

Show less

Try Risk Free